Benefits of SAP Course For Accounting Professionals

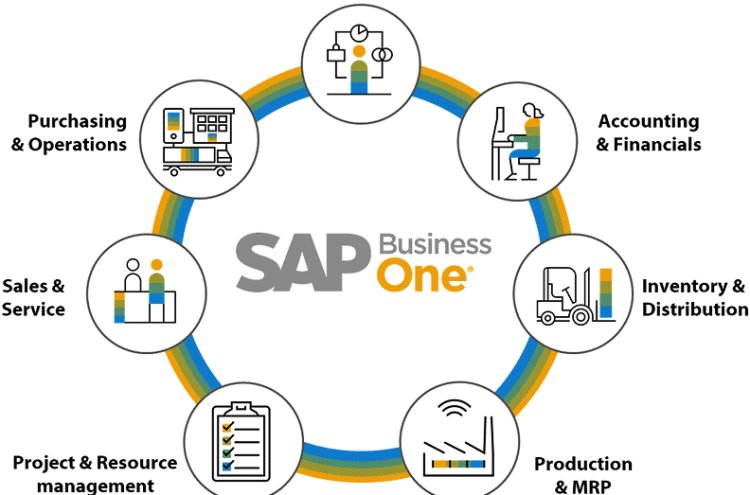

The SAP course offers great benefits to accountants, providing them with a superior tool for the effective management of financial processes. Once professionals master SAP's modules related to finance, FICO, for example, accounting can be streamlined to ensure tasks such as accounts payable and accounts receivable are made simpler and financial reporting becomes efficient with reduced manual errors. SAP’s real-time data processing capabilities enable better decision-making by providing instant access to critical financial insights. Additionally, the course provides a competitive edge, as SAP proficiency is highly valued in industries worldwide. It also aligns with digital transformation trends, preparing professionals to meet modern business demands.

With constantly evolving business situations, today, technology forms a core that enhances financial operation efficiency. Among some thousand tools of today's business scenario, the most imperative for a leading-edge success would be the enterprise resource planning software suite named SAP Course or Systems, Applications, and Products in Data Processing. The benefits it has in store for accountancy professionals can be humongous with better opportunities and improvement in financial skills. This post discusses the Benefits of SAP course to accounting professionals, which elucidates its importance and integration.

Why SAP Course Is Important for Accounting

Professionals In the corporate world, SAP software has widespread use in terms of business operations and customer relationships with efficiency. It allows the accountants to handle more significant financial processes within its strong platform, complying strictly while generating reports of correctness. The modules- -Financial Accounting (FI) Control (CO), and Materials Management (MM) add more versatility to professionals striving for mastery in the field of modern financial practice.

Here's why learning SAP is important for accounting professionals:

- Overall Financial Management

SAP offers a whole package that includes all forms of financial management, such as ledger entries to tax compliance. This enables accountants to record information correctly and, at the same time, keep it in accordance with regulations. - Global Standardization

SAP is considered a benchmark globally for ERP solutions. Professionals who are trained in SAP can easily work with multinational corporations and adjust to international accounting standards. - Advanced Reporting and Analytics

The reporting capability of the platform is very powerful, providing real-time insights, which is crucial for decision-making. Accountants can generate customized reports to analyze financial performance and predict future trends. - Integration with GST and Taxation Modules

It integrates well with GST and other tax modules, making it a useful tool for professionals who have completed a GST or a Taxation Course. It makes the filing process easy and ensures that local tax regulations are complied with.

Benefits of SAP Course For Accounting Professionals

- Better Career Opportunities

The SAP certification provides accounting professionals with a competitive advantage in the job market. Organizations are keen on recruiting candidates who are well-versed in ERP tools since this reduces the need for extended on-the-job training. SAP knowledge offers opportunities in the following roles:

- Financial Analyst

- SAP Consultant

- ERP Manager

- Accounts Manager

Accountants who are well-versed in SAP are also in high demand across industries, including manufacturing, IT, healthcare, and retail.

2. Enhanced Productivity

SAP automation tools minimize the manual work, so accountants can focus on strategic tasks. From automating invoice processing to streamlining tax calculations, SAP helps professionals save time and reduce errors. This increased efficiency translates to better productivity and performance.

3. Real-Time Data Access

Real-time financial data becomes immediately accessible by using the platform provided by SAP to facilitate quicker, informed accounting decisions. Auditing, financial planning, and budgeting become especially effortless using the tools offered through this technology. As such, accounting in this platform allows them to maintain flexibility while adapting to shifting markets.

4. Compliance Risk Management:

Accounting includes the following: tax compliance is an essential part of accounting. The built-in compliance feature in SAP makes it easy to follow standards such as GST. Professionals who have undertaken a GST Course can use SAP to ensure proper GST returns, reconciliation, and filings.

Risk management tools are also offered on the platform, which can detect problems before they become too severe and thus protect the financial health of the organization.

5. Easy Integration with Other Accounting Tools

SAP integrates well with other financial tools and software, making it a versatile choice for accountants. Whether it’s payroll management, tax compliance, or financial analysis, SAP acts as a central hub for various accounting activities. Professionals with an Accounting course background can leverage this integration to optimize processes.

The best SAP FICO Course is focused on the use of the finest methods for teaching financial accounting. The curriculum makes it easy to understand the basics of accountancy for all students.

Industry Need for SAP-Trained Accountants

Organizations around the globe are adopting SAP to streamline their finance operations. Here are some insights into the industry:

- Manufacturing: SAP's modules on material management and costing are very important for tracking the cost of production and inventory.

- Retail: SAP helps retailers handle their point-of-sale system, logistics, and financial statement reporting.

- Health: For the healthcare industry, the SAP assists in maintaining a budget, billing, and complying with regulations

- IT and Consulting: There is great demand for SAP consultants who implement tailor and maintain ERP systems

Helps Make Your Resume Much Better

An SAP FICO Certification gives an edge in the job market. Top recruiting agencies and multinational companies actively look for those who have expertise in SAP FICO and SAP Business modules.

Along with this comes this certification testifying to industry expertise with hands-on experience as an SAP End User and proficiency using the software and is an extremely sought-after candidate in the top grades for roles.

How to Apply for an SAP Course

1. Identify Training Institutes

Find institutes that offer SAP certification and have courses on financial accounting, controlling, and taxation.

2. Identify Your Module

SAP offers various modules that suit different jobs. For accountants, FI (Financial Accounting) and CO (Controlling) modules would be appropriate.

3. Combine with Other Courses

Pair your SAP training with other courses like the GST, Tally Course, and many more for an all-around skill set.

4. Choose Practical Training

Make sure that the course has hands-on training and real-world projects to understand SAP's application in professional situations.

Conclusion

SAP courses have benefits for accounting professionals. From greater career prospects to increased productivity, SAP enables accountants to find the skills that help them move on to excel in the financial landscape.

Whether you are just entering the accounting profession or have experience as a seasoned professional, SAP training is an investment that will pay off across your career. Leverage the power of SAP to transform the way you perform accounting and financial management tasks.

What's Your Reaction?